Does Car Insurance Cover Hail Damage?

Hail can be a car owner’s nightmare, causing significant damage in a matter of minutes. The question of whether car insurance covers this type of damage is crucial for those living in hail-prone areas. Typically, hail damage is covered under the comprehensive portion of your car insurance policy, which also protects against other non-collision events like theft and fire. In this post, we will share the types of insurance that cover hail damage and guide what policyholders can expect if their vehicle is damaged by hail.

Does Car Insurance Cover Hail Damage?

Yes, car insurance can cover hail damage to your vehicle, but only if you have comprehensive coverage.

Comprehensive coverage is an optional part of a car insurance policy that covers damage to your vehicle from events outside of your control, often including:

- Hail and other weather-related damage

- Fire

- Floods

- Vandalism

- Theft

- Crashing into animals

- Falling objects (like tree branches)

Liability insurance, which is typically required by law, does not cover hail damage. Liability insurance only covers damage you cause to others’ property or injuries you cause to others.

Here are some key things to remember about hail damage and car insurance:

- Review your policy details: Always check your specific policy wording to confirm if comprehensive coverage is included and what exactly it covers.

- Deductible applies: You will likely have to pay your deductible before your insurance kicks in for hail damage repairs. The deductible is the amount you pay out of pocket before your insurance company starts covering the cost of repairs.

- Consider your location: If you live in an area prone to hailstorms, it might be wise to have comprehensive coverage regardless of the value of your car.

How Do I File an Insurance Claim for Hail Damage?

Here’s a breakdown of the steps involved in filing an insurance claim for hail damage:

1. Document the Damage:

- Safety first: Only go outside to assess the damage once the hailstorm has passed.

- Take photos and videos: Capture close-up and wide shots of the hail damage on your car, including dents, cracks, or broken windows. If possible, note the date and time with the timestamp function on your camera.

- Inventory the damage: Make a list of all the damaged areas on your car.

2. Contact Your Insurance Company:

- Call your agent or the insurance company’s hotline: Inform them that you’d like to file a claim for hail damage to your car.

- Have your policy details ready: This includes your policy number and any other relevant information your insurance company might ask for.

3. File an Official Claim:

- The insurance company will likely guide you through the claim process. This might involve filling out online forms or submitting a claim form over the phone.

- Be honest and accurate: Provide truthful information about the hail damage and how it happened.

4. Meet with an Adjuster:

- The insurance company will likely send an adjuster to inspect the damage: The adjuster will assess the severity of the damage and estimate the repair costs.

- Be present during the inspection if possible: This allows you to point out any specific concerns you have about the damage.

5. Get Estimates for Repairs:

- You may be required to obtain repair estimates from body shops: Get quotes from at least two reputable shops to compare prices.

6. Review the Settlement Offer:

- The insurance company will offer a settlement amount: This is the amount they will pay to cover the repairs, minus your deductible.

- Review the offer carefully: Ensure it covers the cost of repairs according to the estimates you obtained. You can negotiate if you feel the offer is too low.

7. Complete Repairs and Receive Payment:

- Once you accept the settlement offer, you can get your car repaired at a shop of your choice.

- The insurance company will typically issue payment directly to the repair shop or reimburse you after the repairs are completed.

How Much Does it Cost to Repair Hail Damage to a Car?

The cost to repair hail damage on a car can vary greatly depending on several factors:\

- The severity of the damage: The number, size, and depth of the dents will significantly impact the repair cost. More extensive or deep dents require more complex repairs and will be more expensive.

- Repair method: There are two main methods for repairing hail damage: Paintless Dent Repair (PDR) and traditional body shop repairs with panel replacement or repainting. PDR is generally less expensive for minor to moderate hail damage.

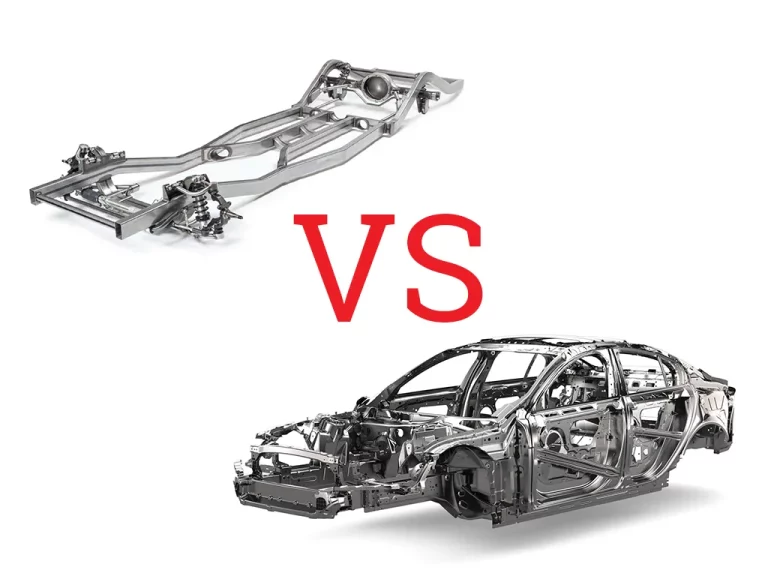

- Car size and material: Larger vehicles with more surface area will naturally cost more to repair compared to smaller cars. Additionally, aluminum panels on some cars might require different repair techniques compared to steel panels, affecting the cost.

- Labor rates: Body shop labor rates can vary depending on your location and the shop’s reputation.

Here’s a general idea of the cost range for hail damage repair:

- Minor hail damage: Small dents might be repairable with PDR for $50-$150 per dent.

- Moderate hail damage: A mix of dent sizes might involve PDR and some minor bodywork, costing $300-$1000.

- Severe hail damage: Extensive dents or large creases might necessitate panel replacement and repainting, potentially reaching $3,000-$10,000 or even higher.

Frequently Asked Questions

What is the impact of hailstorms on vehicles in the US?

Hailstorms can inflict serious damage on vehicles, leading to hefty repair costs. Depending on the severity of the damage, it’s essential to have comprehensive insurance coverage to handle these expenses.

How does the process of filing insurance claims for hail damage work?

The process for filing insurance claims for hail damage typically involves contacting your insurer, providing details about the damage, and arranging for an inspection. The costs can vary, depending on whether the damage is minor or severe.

How can I protect my car from hail damage?

Protection measures for your car during a hailstorm include moving your vehicle to a sheltered area or using temporary solutions like car covers or blankets. Acting promptly to prevent further damage, like rust, is crucial.

Why is comprehensive insurance important for residents in hail-prone areas?

If you reside in a hail-prone area, comprehensive insurance coverage is pivotal. This will ensure that you have the necessary funding for repairs following a significant hailstorm, highlighting the importance of preventive protection.

Can hail smaller than an inch damage my vehicle?

Damage from hail that is smaller than an inch is unlikely under normal conditions. If the hail is wind-driven or extremely dense, it may cause damage. However, hail an inch or larger poses a high risk of harm to your vehicle.

Are hail-damaged vehicles sold at discounted rates?

Depending on the cost of repair and its impact on the resale value, dealers may sell damaged cars at discounted prices. The new owner would then assume responsibility for the repairs.

Is buying a hail-damaged car a good idea?

If a hail-damaged car is mechanically sound and has minimal cosmetic issues and you’re open to dealing with these, you could get a great bargain. However, be aware that hail damage can significantly reduce a vehicle’s resale value.

Hi! I’m Larry Gibbs, studying mechanical engineering with a focus on cars. I really love Ferraris and write blog posts about the latest car stuff. When not studying or blogging, I’m usually on a road trip exploring new places. I also enjoy playing football and watching movies. Life’s an adventure, and I’m all about enjoying the ride!